- +233(545-702-789)

- techstartgh@gmail.com

Igris Automated Trading System

- Home

- portfolio

- QuantSystems

- Igris Automated Trading System

How it Works

Igris is a cutting-edge trading automated systemdeveloped by TechStartGH, purpose-built to enhance precision, efficiency, and trader performance in the financial markets.Designed using the MQL4 programming language, Igris integrates seamlessly with MetaTrader 4 to execute trades automatically based on predefined conditions, strategies, and market signals.

Built to support retail traders, prop-firm users, and algorithmic enthusiasts, Igris helps maximize opportunities even when the trader is away from their screen.Whether used for scalping, day trading, or swing trading, the system blends automation with user control — allowing the trader to set risk preferences, trading hours, and strategy parameters while Igris takes care of execution.

“We the People have experienced firsthand how transformative Igris truly is. Before adopting the trading bot from TechStartGH, we struggled with consistency, emotional decision-making, and the time demands of manual trading. Igris changed that.

The automation is reliable, the execution is fast, and the ability to set trading times gives us full control over when and how the bot works. We now trade with confidence, knowing that our strategies are executed exactly as intended—even when we are away from our screens.

TechStartGH delivered not just a trading tool, but a silent partner that helps us trade smarter, stay disciplined, and achieve better results. We proudly recommend Igris to any trader seeking performance, reliability, and intelligent automation.”

– MACEY GREENE – WETHEPEOPLE

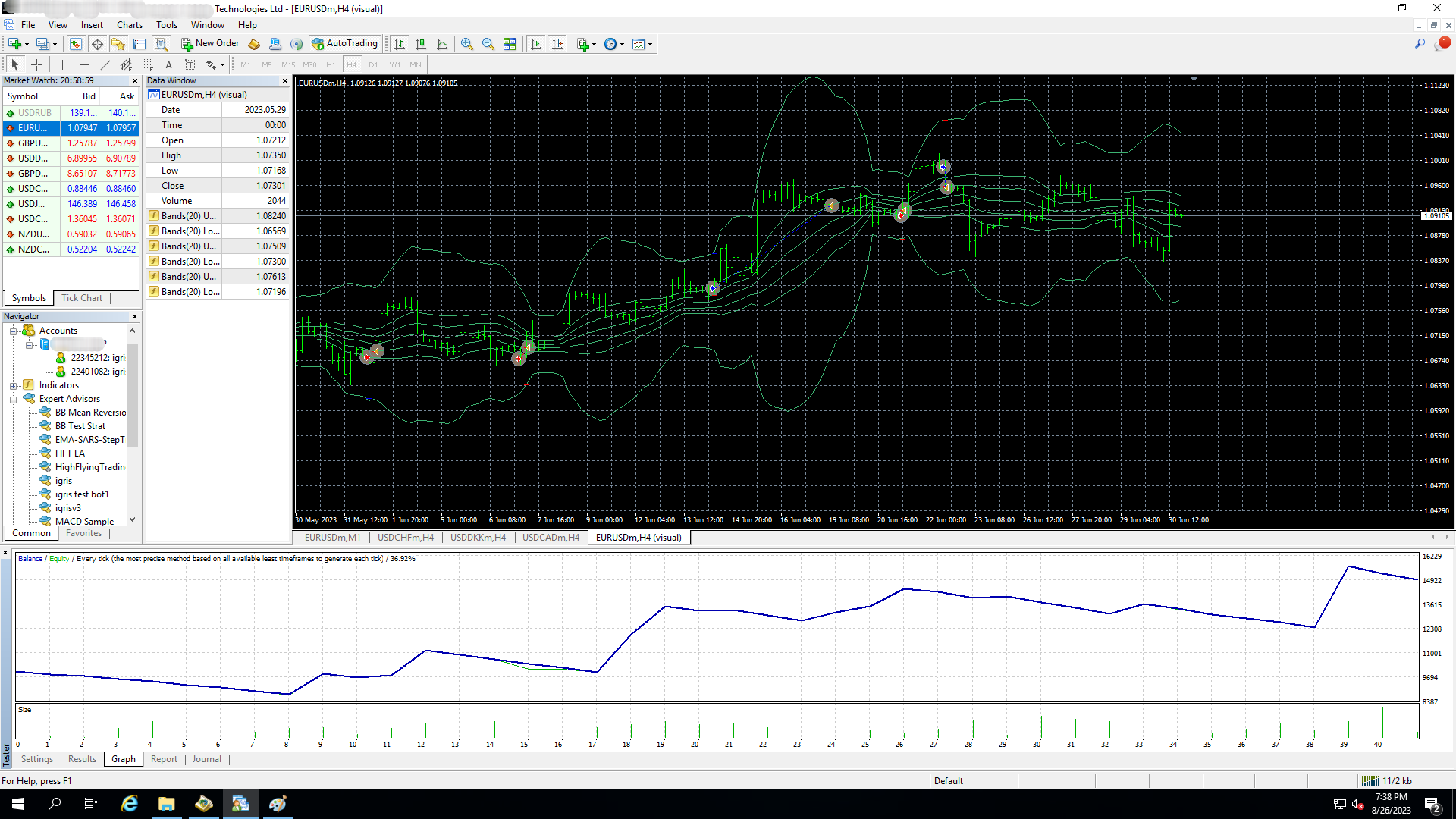

Process & Results

Automating trade execution — Buy and sell orders are placed without manual intervention once market criteria are met.

Custom scheduling — Users can specify active trading times, enabling the system to operate only during preferred market sessions.

Data-driven decision making — The algorithm evaluates market conditions, detects opportunities and executes trades with speed and consistency.

Reduced emotional influence — By removing manual decision-making, Igris improves discipline and reduces human error.

Built to support retail traders, prop-firm users, and algorithmic enthusiasts, Igris helps maximize opportunities even when the trader is away from their screen.

Whether used for scalping, day trading, or swing trading, the system blends automation with user control — allowing the trader to set risk preferences, trading hours, and strategy parameters while Igris takes care of execution.

Built using MQL4, Igris integrates with MetaTrader 4 and can execute trades automatically on behalf of the user. Traders simply set their preferred conditions — including entry rules, risk settings, and specific trading times — and Igris handles the rest.

The bot monitors market activity, identifies trade setups, places orders, and manages positions without needing manual input. This reduces emotional bias, ensures fast execution, and allows trading even when the user is offline.

Igris is designed to support beginners and experienced traders who want to improve consistency, reduce workload, and leverage automation for smarter trading decisions.

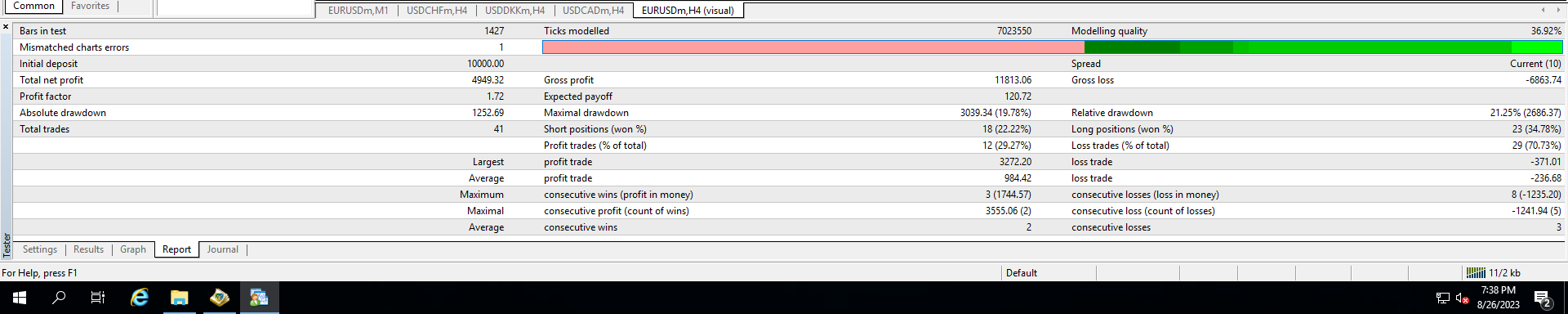

Challenges And Solutions

Even though automated trading offers efficiency and precision, building and operating a reliable trading bot like Igris involves real challenges. TechStartGH designed Igris with these issues in mind and engineered practical solutions to overcome them.

1. Market Volatility & Unpredictability

Challenge:

Financial markets can shift rapidly, making it difficult for rigid systems to respond effectively.Solution:

Igris uses adaptive algorithms and configurable risk parameters, allowing traders to fine-tune stop-loss levels, trading hours, and strategy logic so the bot reacts appropriately to changing market conditions.2. Over-Optimization of Strategies

Challenge:

Bots can perform well in backtests but fail in live markets due to overfitting.Solution:

Igris offers real-time performance monitoring, enabling users to test settings under live conditions and adjust until the strategy stabilizes — promoting realistic decision-making rather than purely theoretical results.3. Emotional Trading by Users

Challenge:

Human fear or greed can interfere with trading results, even with automation.Solution:

By allowing full automation once parameters are set, Igris removes emotional interference and executes trades strictly according to logic, helping maintain discipline.4. Risk Mismanagement

Challenge:

Without proper controls, automated trading can lead to large losses.Solution:

Igris includes customizable risk controls such as lot sizing, maximum trade limits, stop-loss placement, and time filters to ensure safe trading boundaries are respected.5. Need for Monitoring and Updates

Challenge:

Markets evolve, so trading bots must evolve too.Solution:

TechStartGH provides ongoing optimization, updates, and support — ensuring Igris stays relevant, resilient, and aligned with current market structures.With these challenges addressed, Igris positions traders to experience smoother automation, increased consistency, and improved strategic execution — without the burden of manual trading.